extended child tax credit portal

The agency offers interpreters in more than 350 languages. This will be half of the total amount paid out with the other half.

Duties And Taxes Not Subsumed Into Gst

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

. For children under age 6. See If You Qualify For IRS Fresh Start Program. To reconcile advance payments on your 2021 return.

For children age 6 through 17. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. See below for more information.

Local time for telephone assistance. The enhanced child tax credit that was passed earlier this year temporarily increases the existing child tax credit from a maximum of 2000 a year per child to 3000 for each child aged 6 to 17. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens.

Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Not a tax deduction Half of the credit can be paid in advance between July 2021 to December 2021. Enter your information on Schedule 8812 Form 1040.

Child Tax Credit Update Portal. Max refund is guaranteed and 100 accurate. The fourth installment of this years Advance Child Tax Credit is set to hit bank accounts today Fri Oct.

Individual taxpayers can call the IRS helpline at 800-829-1040 from 7 am. Free means free and IRS e-file is included. To be eligible for this rebate you must meet all of the following requirements.

The 6 monthly Child Tax Credit payment amounts will total. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens. From the enhanced child tax credit to universal pre-K Build Back Better makes historic investments to help parents VIDEO 827 0827 How a 31-year-old US.

Claim the Tax Refund You Deserve. Parents income matters too. While not everyone took advantage of the payments which started in July 2021 and.

For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. Here is some important information to understand about this years Child Tax Credit. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. 2021 Child Tax Credit and Advance Payments. A childs age determines the amount.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. To reconcile advance payments on your 2021 return. Ad File to Get Your Child Tax Credits.

The 19 trillion American Rescue Plan which President Joe Biden signed into law in March 2021 made several significant changes to the existing child tax credit for last year. Biden administration has relaunched the simplified non-filer sign-up tool for low-income families who have yet to claim their expanded Child Tax Credit Families must claim their expanded Child Tax Credit by October 2022 Counties remain a critical partner in encouraging families to use the simplified portal to claim their credit. You must be a resident of Connecticut.

You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age. Get your advance payments total and number of qualifying children in your online account. The enhanced child tax.

How To Change Your Direct Deposit Information on the Child Tax Credit Update Portal Checks in the amount of either 300 or 250 will be deposited. For this 2022 tax year the money will be distributed as a single end-of-year tax credit per the previous program from the Internal Revenue Service IRS. Havent Received a Child Tax Credit PaymentCheck if Youre Eligible Find.

The Child Tax Credit provides money to support American families. The total advanced credit amount delivered in 2021 over 6 months will be. On May 11 the White House in.

For children age 6 through 17. This means that the total advanced credit amount delivered in 2021 will be. It increased the.

For children under age 6. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Free Case Review Begin Online.

The tax credit is expanded to include ad. Ad Based On Circumstances You May Already Qualify For Tax Relief. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The advance Child Tax Credit or CTC payments began in July 2021 and end by 2022. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

Free Editable Startup Funding Proposal Template Word Template Net

How To Know Gst Registration Number From Tin Number

Gstr 9c Due Date For Annual Return Form 2020 21 Ca Portal Dating Form Due Date

Cbic Issues Notices To Companies For Itc Refund With Interest Indirect Tax Company Data Analytics

Super Cool Taxtips To Help You Win Taxes Visit Https Tax2win In File Your Return For Free Itr1 Itr Taxtips Tax2win Hap Tax Credits Tax 2 More Days

Support Tickets System For Mailwizz Ema Priority Management System Supportive

Electronic Gst Refund Portal Refund Electronics Department

Itba Conversion Of Case From Limited To Complete Scrutiny Reg

Deadline For Filing Form Gst Tran 1 Extended To 31st March 2020 Indirect Tax Data Analytics Filing Taxes

Gstr 1 Gstr 2 And Gstr 3 Due Dates Extended Dating Due Date Extended

If You Are Still Struggling With Gst Return Mismatches Then Hostbooks Gst Is Right Here To Help You Out We Billing Software Accounting Software Payroll Taxes

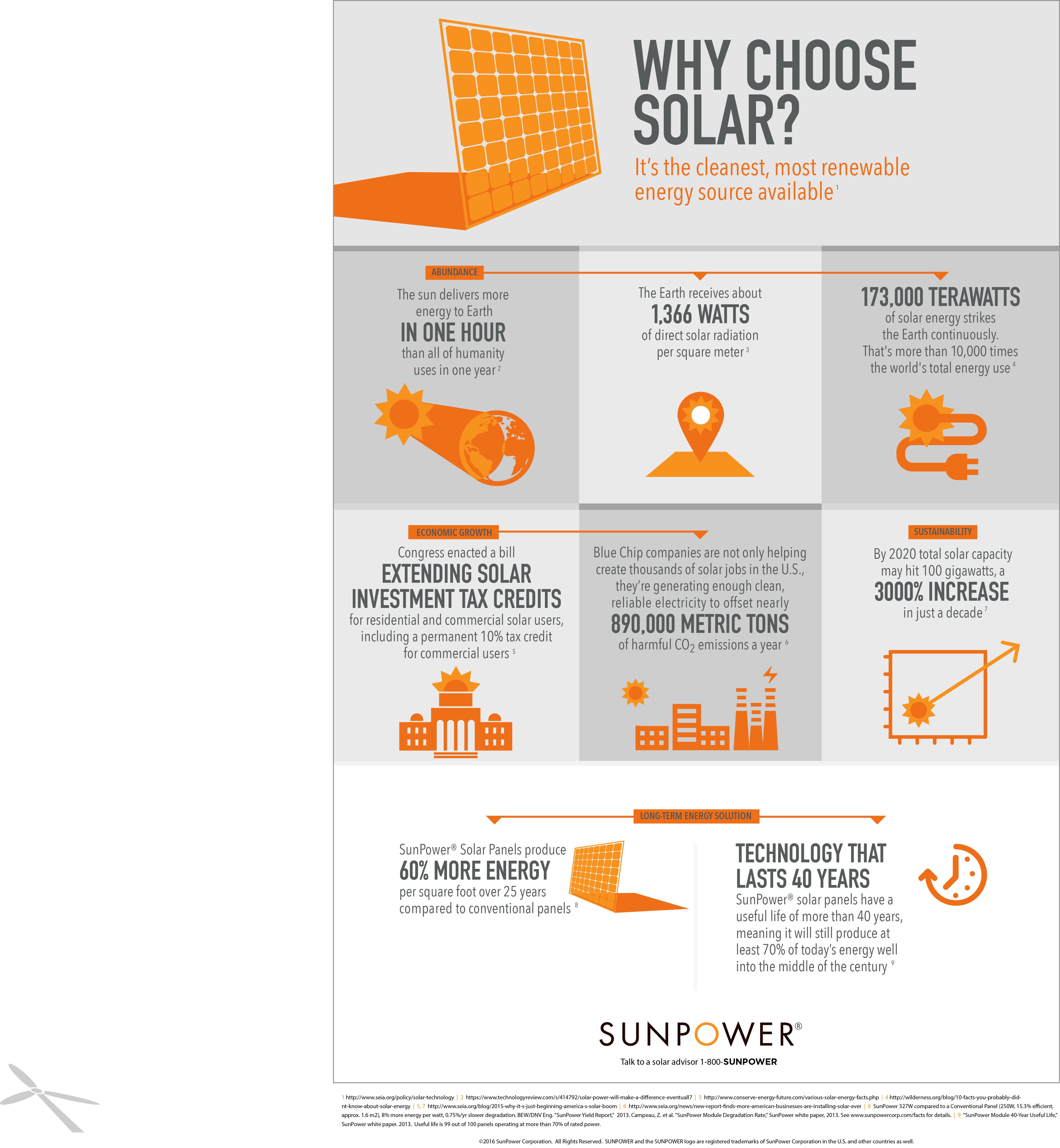

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog

Gst Cbic Extends Gstr 9 And Gstr 9c Filing Dates In A Staggered Manner Retail News Goods And Service Tax The Borrowers

7 Day Extension At Last Moment What A Shame Cbdt Has Extended Due Date For Filing Itrs Tax Audit Reports Under Income Income Tax Return Income Tax Due Date